My goal is to make you mad. Not at me (though I expect to ruffle a few feathers with this one). At the evil being wrought in the name of fighting inflation and maximizing employment. And at the aggressive indifference to this evil, exhibited by the capitalists, the gold bugs, and the otherwise-free-marketers.

So, today I am going to do something I have never done. I am going to rant! I am even going to use vulgar language (which is totally justified).

In researching several recent articles, I re-read old passages from Keynes. Consider these snippets:

“For a little reflection will show what enormous social changes would result from a gradual disappearance of a rate of return on accumulated wealth.”

“In short, the aggregate return from durable goods in the course of their life would, as in the case of short-lived goods, just cover their labour-costs of production plus an allowance for risk and the costs of skill and supervision.

Now, though this state of affairs would be quite compatible with some measure of individualism, yet it would mean the euthanasia of the rentier, and, consequently, the euthanasia of the cumulative oppressive power of the capitalist to exploit the scarcity value of capital.”

Keynes wrote this crap in The General Theory of Employment, Interest, and Money in 1936. Before I pick it apart, I want to cite again what he said 14 years earlier, in The Economic Consequences of the Peace.

“Lenin is said to have declared that the best way to destroy the Capitalist System was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth. Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become "profiteers," who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.”

“Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

“…the fatal process which the subtle mind of Lenin had consciously conceived.”

So this fucker (that’s wanker in English), in 1922, clearly describes how to overthrow capitalism. At that time, he couched it behind Lenin’s alleged words (it’s controversial whether Lenin really did say this). But it’s clear that he understood it, much more clearly than his latter day critics.

Then in 1936, he writes of “enormous social changes” of a “gradual disappearance of a rate of return on accumulated wealth.” No longer does he hide behind Daddy Lenin.

And to what social change would he be referring? Would it be “to destroy the Capitalist System”? And what the hell does a “gradual disappearance of a rate of return mean”? This means pushing the rate of interest down to zero.

Keynes well knew that asset prices are the inverse of the rate of return. He understood that this meant that asset prices would skyrocket! And he notes that this “does it [the destruction of the capitalist system] in a manner which not one man in a million is able to diagnose.”

“The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth.” Today, this is called the problem of inequality. Which the capitalists and otherwise-free-marketers actually defend. They think that this rising disparity between asset owners and wage earners is a feature of free markets! Keynes knew better.

Getting back to Keynes, he said, “all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.”

A gamble and a lottery. Huh? Like speculating on stocks, ICOs, precious metals, real estate, and everything else?

He laid out his plan to destroy. In clear language—this is no sleep-aid full of differential equations and language designed to obfuscate.

Keynes is the Ellsworth Toohey of economics. Toohey, the villain in The Fountainhead, was portrayed as very intelligent—and evil. He used his smarts to bamboozle people to destroy themselves. Keynes did it at an even larger scale.

He gave us the recipe for “overturning the existing basis of society.” All you have to do is “a continuing process of inflation,” which will “confiscate, secretly and unobserved, an important part of the wealth of their citizens.” This “brings windfalls, beyond their deserts and even beyond their expectations or desires” to the “profiteers, who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat.” Finally, this process “engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

The only leap that I am making would seem to be from “inflation” to “the euthanasia of the rentier.” People today think of inflation only in terms of one of its possible effects: rising prices. This is the fallacy of the frozen abstraction, which Ayn Rand said “consists of substituting some one particular concrete for the wider abstract class to which it belongs…”

Note what Keynes first says about the process of inflation: ”…governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens.”

Rising commodity prices is one possible consequence. But rising asset prices is another, and it also fits Keynes’ recipe. Note that his discussion of “enormous social changes” and the “oppressive power of the capitalist to exploit” is not about rising commodity prices, but about falling interest rates.

Keynes sees the connections between: (1) confiscating the wealth of the people, (2) generally impoverishing the people, (3) but arbitrarily enriching a few, (4) which means some prices rise and those who bought those things profit, (5) and the process of wealth-getting degenerates into a gamble and a lottery, (6) pushing interest down to zero, (7) which means pushing asset prices to infinity, (8) leading to resentment against the enriched even by members of their own bourgeois class, (9) which causes the breakdown of relations between debtors and creditors, and finally (10) the best way to destroy the Capitalist System, (11) in a manner which not one man in a million is able to diagnose.

That motherfucker. I’m sorry, but the normal words of the English language do not give me a way to describe how I feel about someone this vicious, and not only malevolent but smart enough to devise such an evil scheme, and lucky enough or persuasive enough to set the entire world on the path to destruction.

Let me be 100% clear: this is the path to the destruction of civilization itself.

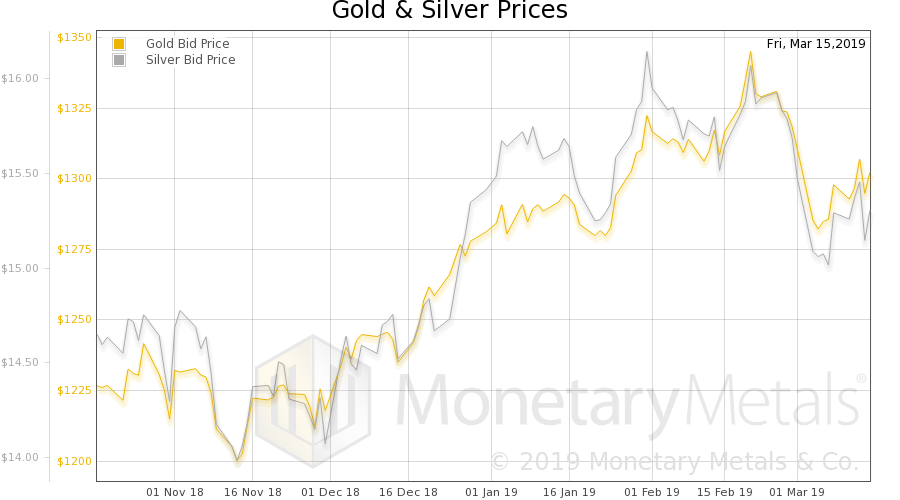

There, as concisely as I can state it, is the problem we face today. At least, those of us who recognize it, face it. However, I named three groups who generally don’t recognize it. They are part of the 999,999 who Keynes said are unable to diagnose it: the capitalists, the gold bugs, and the otherwise-free-marketers. Next week, I will get out of rant-mode and address the ideas promoted by these groups. Supply and Demand Fundamentals The price of gold went up three bucks, and silver down three cents. In other words, not much at all. We saw one article this week, that casually mentioned the “"Yellen gold standard", and said that it is not “in its Powell phase.” By this notion, Powell maintained this so-called gold standard for yet another week. That is, assuming he has control over the price of gold. Which he does not. And assuming that a good gold standard means a fixed price. Which it does not. And that $1,300 is the right price, which no one could know. And assuming the Quantity Theory of Money is correct, that the Fed can set the price of gold by setting the right quantity of dollars, which is not true even if the dollar were money, which it is not. And assuming he thinks about gold, which he does not. Anyways, enough beating this faux gold standard dead horse. Not much happened to the prices of the monetary metals. The action was in the risk-on assets, such as the stock market, the euro, crude oil, etc. In other words back to normal! This is how the capitalists suppose it should work—chronic net increases in borrowing, to fund chronic bidding up of assets. So they can get richer. It seemed to be working this week. However, one thing that isn’t working is the spread between junk bonds and Treasurys. There are lots of weak companies out there, who need to keep borrowing to keep adding to GDP stay alive. If their cost of funding is rising, then they are in trouble. Many creditors who—perhaps unwisely—reached for yield, will incur big losses. From around the start of 2016, this spread was falling. It reached its absolute low point of 3.16% on Oct 3 last year. Since then, it’s been trending upwards. It’s come down since its peak in December, but is now around 4%. Another bout of capital-consuming rentier-euthanizing, falling-return rising asset prices will require that they get this spread under control. There’s no reason why they can’t set the 10-year Treasury at 1% and the spread for junk bonds at + 2% to that—just imagine how much GDP could be added if the riskiest and poorest-performing businesses could be forced-fed credit at 3% cost! We shudder to think of it. However, it seems a likely course. And one where many people turn to gold to protect them. It will be obvious to millions of people that such a course of action will have drastic consequences. But, as they say (well as we say), today is not that day. Anyways, let’s look at the only true picture of the supply and demand fundamentals of gold and silver. But, first, here is the chart of the prices of gold and silver.

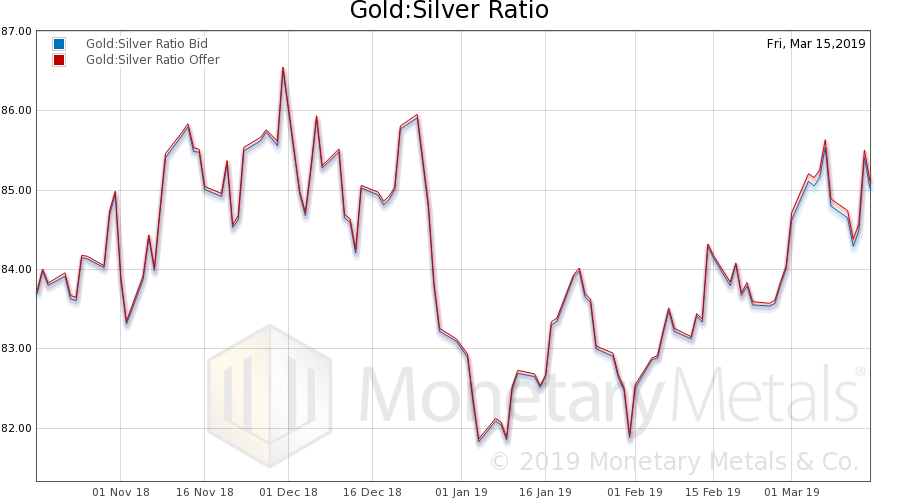

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It was up a bit this week.

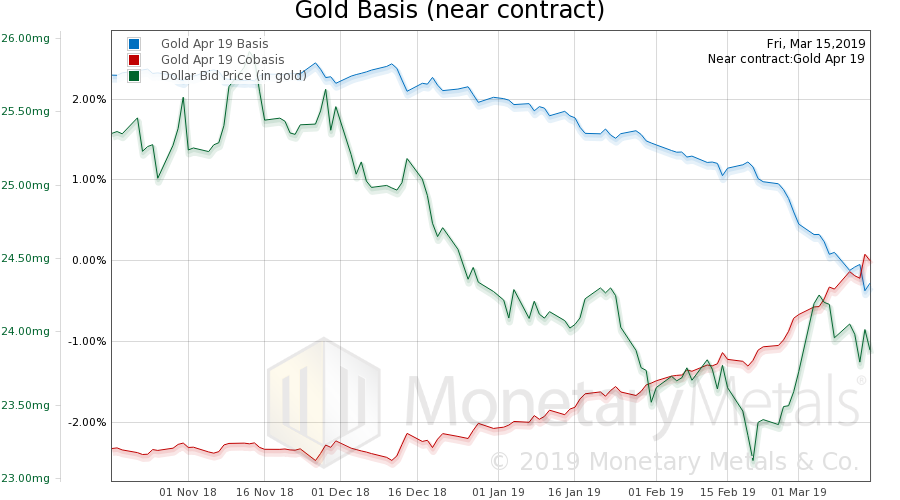

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

The scarcity (cobasis) of gold is up this week. And the Monetary Metals Gold Fundamental Price made another new high, up $60 now to $1,497. Now let’s look at silver.

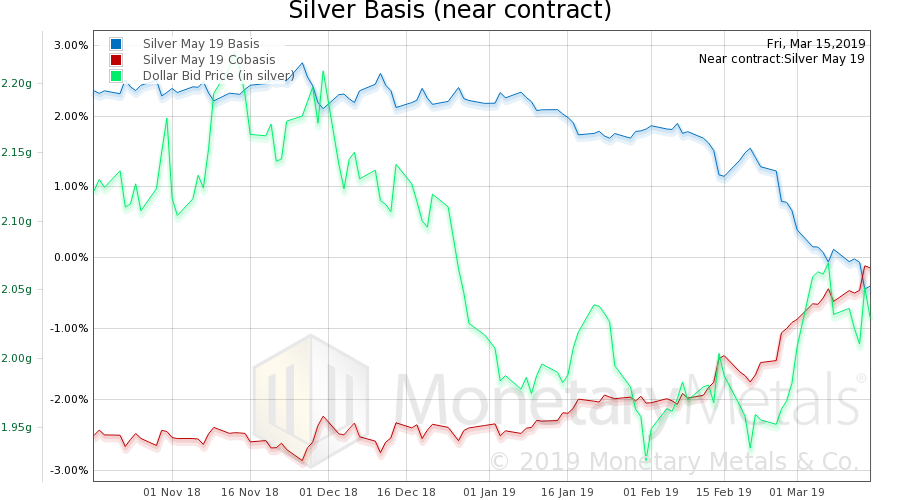

Silver shows rise in scarcity too. And the Monetary Metals Silver Fundamental Price is up 20 cents to $16.30.

© 2019 Monetary Metals