Warren Buffett Shorts The Economy, 18 August

It must be Monday, because the price of silver skyrocketed.

From $26.10, it shot up to $27.50, or +5.4%. The last time we wrote about silver was after its crash to $25. Silver is now priced 10% above that low point.

But First: The Sage Does a 180

The big news in the monetary metals is that Warren Buffett—famed disliker of gold—sold bank stocks to buy gold mining shares. What’s interesting to us is not that we think he has any special powers to predict the gold price. After all, he famously bet on silver, and lost.

What’s interesting is that he understands, intuitively, that owning a piece of gold is not an investment. He may have been disingenuous in his dismissals of gold, which he did to defend the regime of irredeemable paper. However, he has a point. A lump of metal does not produce anything.

And unless he has suddenly changed his views, his buying a gold mining stock indicates that he now thinks that it’s better to own a metal which produces nothing—and of course loses nothing—than to own stocks. Or at least bank stocks.

Yes, we know that he did not buy gold metal. He bought a company that he expects to be geared to the gold price.

And Here’s Why

We won’t opine on Barrick shares, but we note that Buffet is not alone in expecting that a lump of metal will outperform stocks. Or, to put this in clearer, starker terms: stocks will fall when measured in gold (but perhaps not, when measured in dollars).

Buffet is indeed shorting, if not the economy, then at least commercial bank, investment bank, and credit card companies. He compares them to a cube of gold—and finds them wanting.

We Fully Agree, Warren

We hope that our message to the gold community may be heard above the din of people cheering. It is not good when business prospects are bad, and doubly not good when the prospects of banks are bad. We are not asking anyone to shed a tear for banks. We are looking through the banks to the slow-motion train wreck that is real estate. Residential, commercial, retail, restaurant, and hotel are all going to experience massive defaults by borrowers. Including the loans that financed those glorious and hip interiors.

We are also looking through the banks to the liability side. Most people think of a bank’s liabilities as money. Banks borrow from everyone, to make loans. If those loans go bad, then that puts stress on the bank’s ability to repay.

Now we see that Warren Buffett, who knows the finance business well, and who has invested in it for decades, is running away from it. And we expect many others are running too.

Monday’s Silver Activity

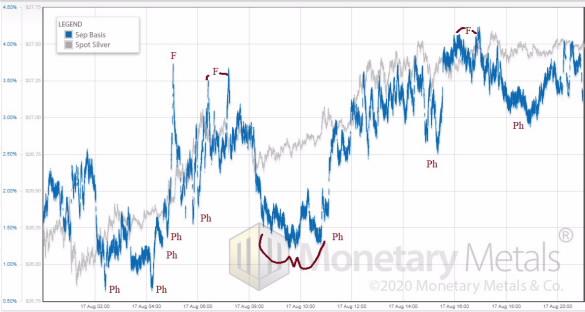

Here’s the chart you’ve been waiting for:

Two things stand out on this chart.

One, the basis correlates with the price. That is, the price action was primarily driven by futures trading.

Two, there are many moments where the basis drops when the price is rising. That means, at those times, the rising price was the buying of physical metal (marked with “Ph”).

We see a few basis spikes, when futures buyers got aggressive (marked with “F”). However, not nearly the number of times that the basis dipped.

It’s almost as if this chart is saying: buyers of silver metal want more metal.

Based on long history, if the price of gold is rising by great percentages over a period of years then the price of silver typically rises by an even-greater percentage.

Funny thing...Monetary Metals' clients already knew that gold can be productive *and *procreative. As a result, they earn interest on their silver and gold. Now. Today.

© 2020 Monetary Metals